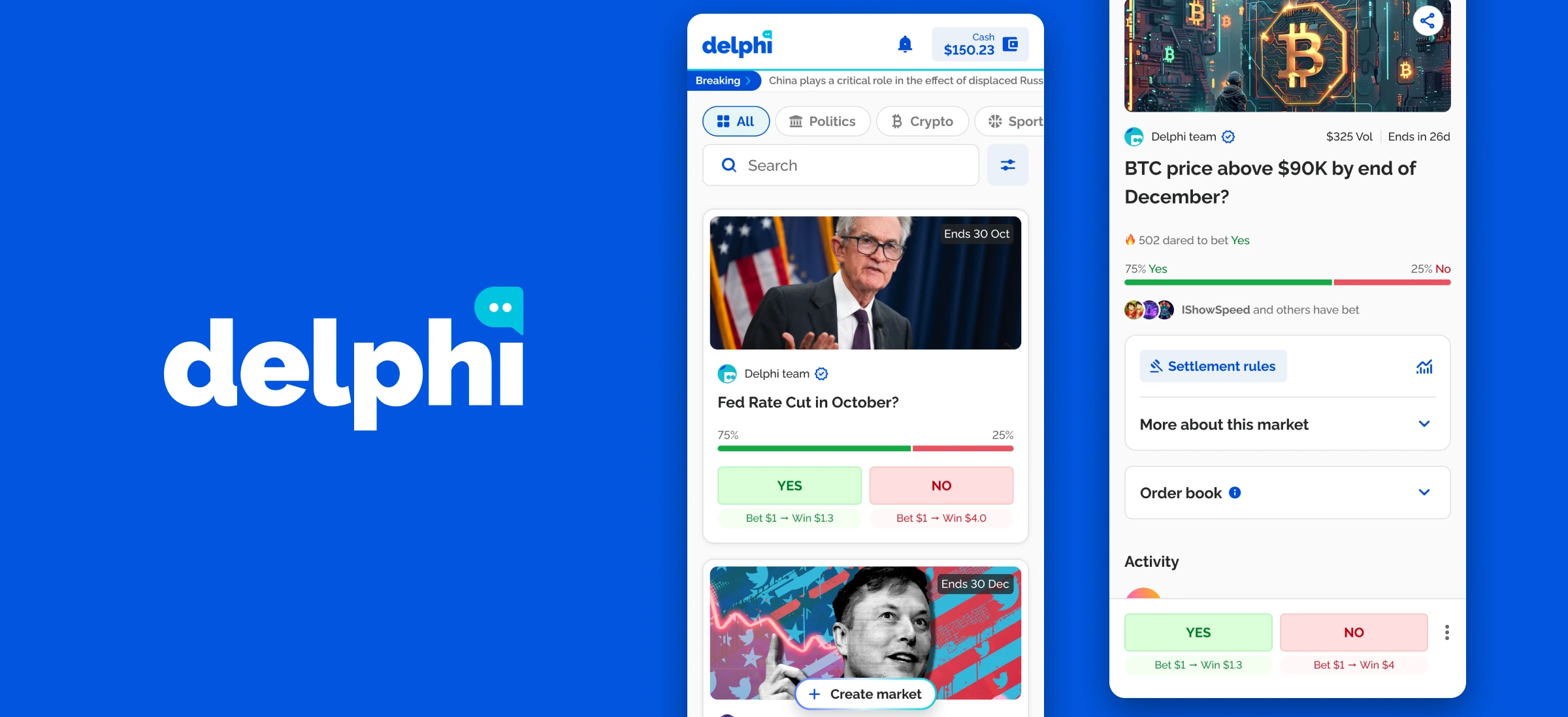

Delphi - Prediction market

Designing for engagement and retention

What is Delphi

Delphi is a prediction market platform within the Cronos blockchain, where users can earn by predicting real-world events, essentially trading on Yes/No outcomes.

Goal

Our goal was to create a fun, intuitive, and accessible prediction market experience, lowering the barrier for first-time crypto users, encouraging deposits, driving retention, and standing out in a crowded market, so users are motivated to choose Cronos’ precision market over alternatives on other chains.

My role

I co-led the end-to-end design of the platform, from discovery to testing, and prototyping to high-fidelity UI and design QA. We delivered the MVP in 6 weeks, followed by 3 weeks of iteration based on community feedback. We also created a scalable, token-based design system (with light/dark modes) and worked closely with PMs and devs throughout. To boost engagement and retention, I introduced the Hook Model as a behavioural UX layer across key interactions.

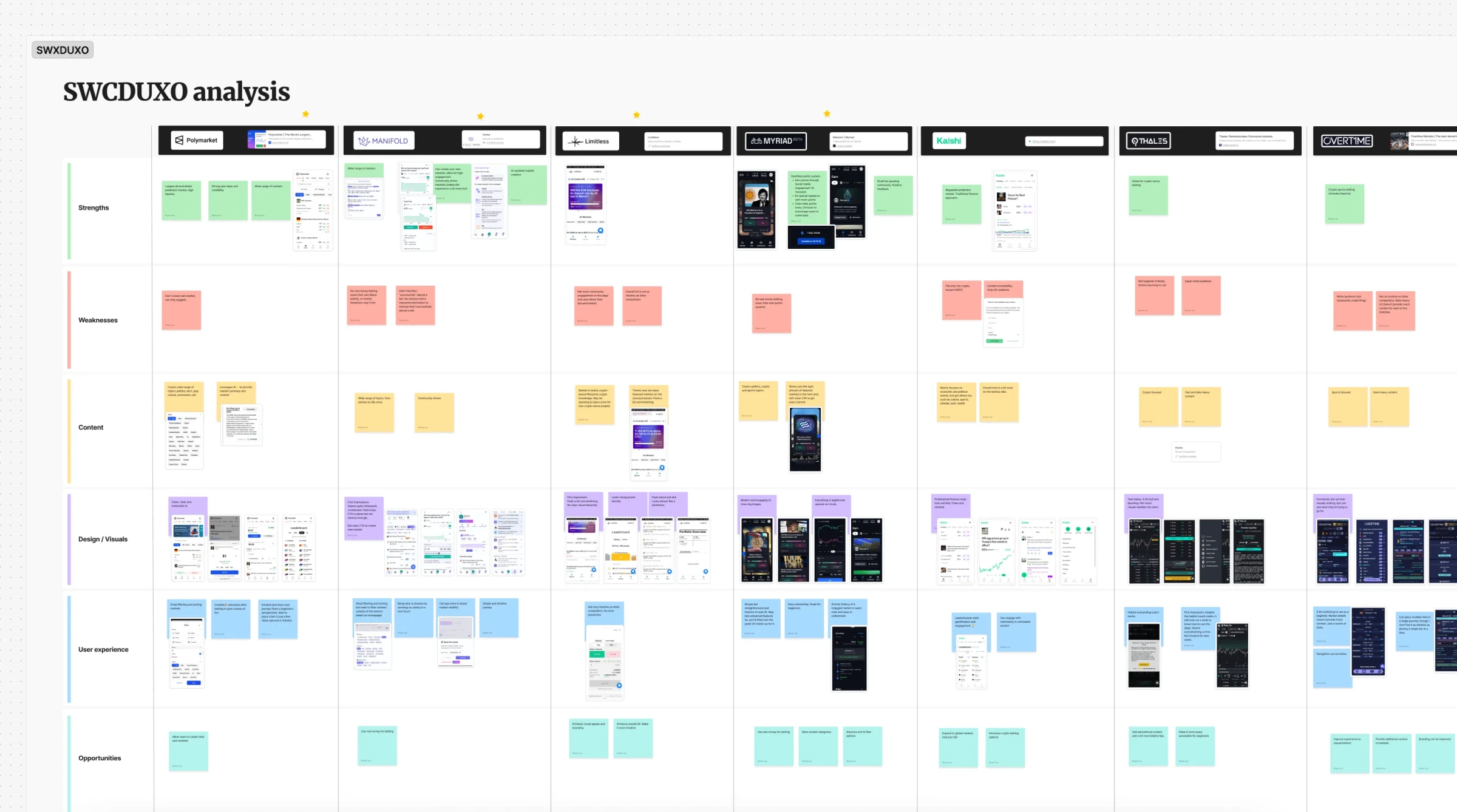

Understanding the competition

After aligning on the UX strategy, I led the analysis of 11 competing platforms to uncover best practices, gaps, and opportunities. I chose the SWCDUXO framework (Strengths, Weaknesses, Content, Design, UX, Opportunities) as a more UX-focused alternative to the traditional SWOT. This approach gave us a clear view of what worked, what didn’t, and where we could differentiate, directly informing product direction and design decisions.

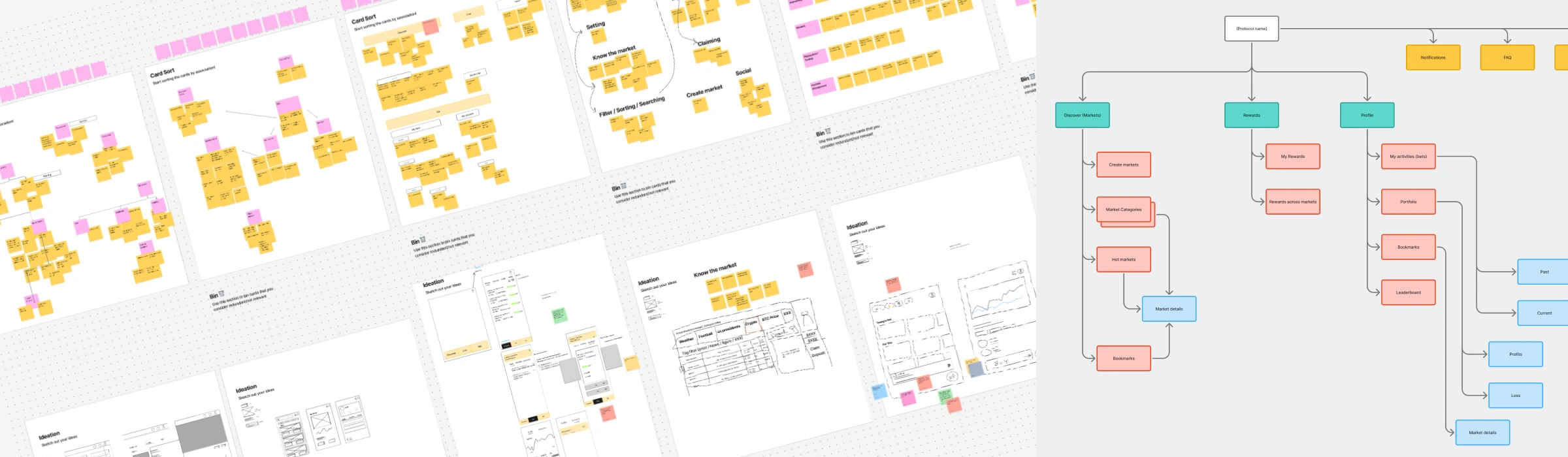

Shaping the information architecture

To better understand users' mental models, we ran a card sorting workshop with 9 participants. Each participant shared their reasoning, sketches, and ideas, which gave us valuable insight into how prediction market users naturally organise information. These findings informed the platform’s navigation structure and core user flows.

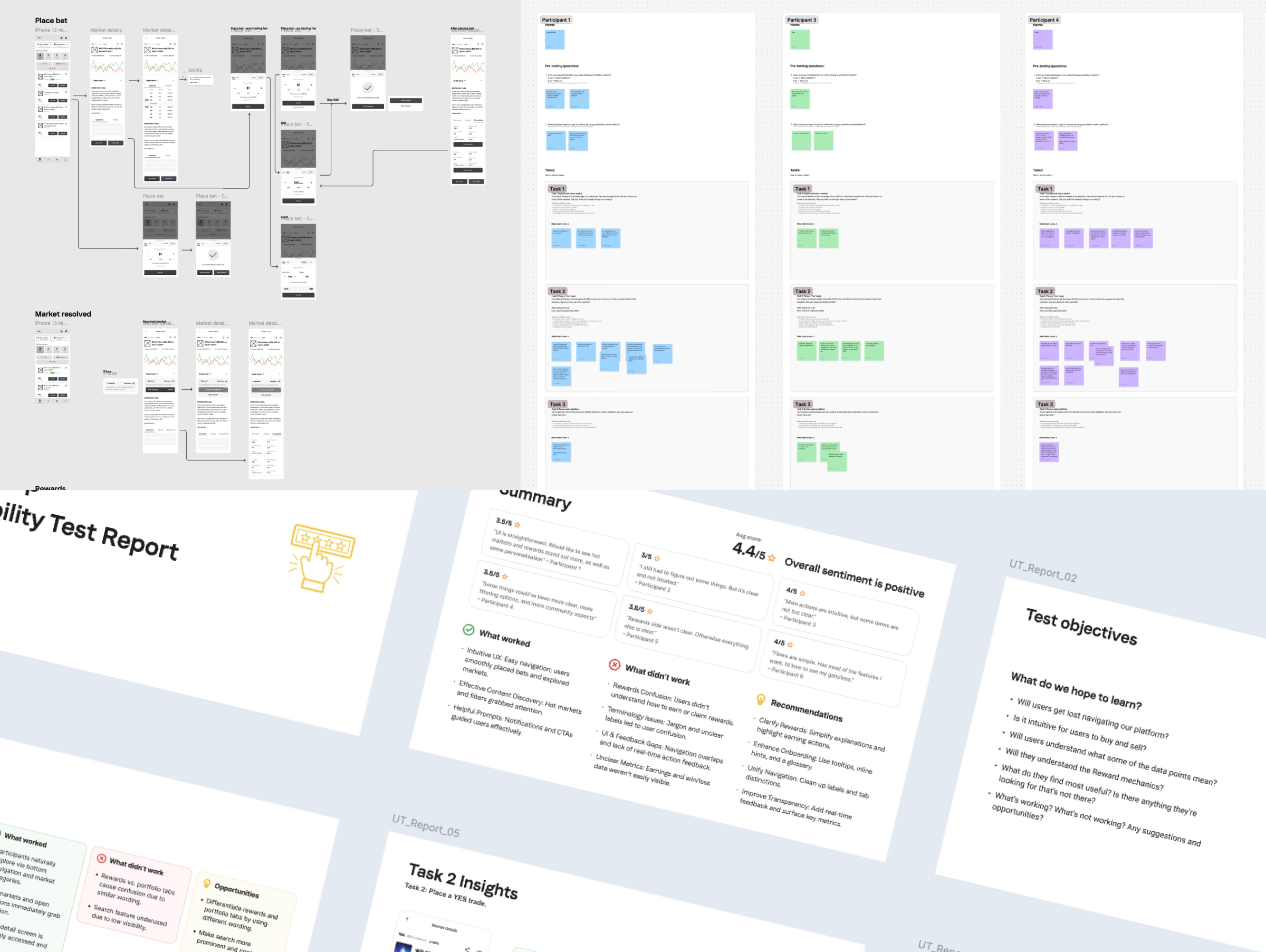

Testing the experience

Using insights from our research, we developed initial wireframes and prototypes. I led and facilitated usability tests with 6 participants, focusing on high-impact user flows: market discovery, placing Yes/No trades, reviewing positions, claiming winnings, and providing liquidity via limit orders.

We began with pre-test questions to understand each participant’s habits and experiences with prediction markets. During the session, they completed 6 key tasks, and gave post-test feedback to assess the overall experience. What users liked, disliked, and what they wanted to see improved, allowing us to assess the clarity, intuitiveness, and effectiveness of our design.

We created a report to present our findings and insights to the team. The insights provided a solid foundation for refining the high-fidelity designs.

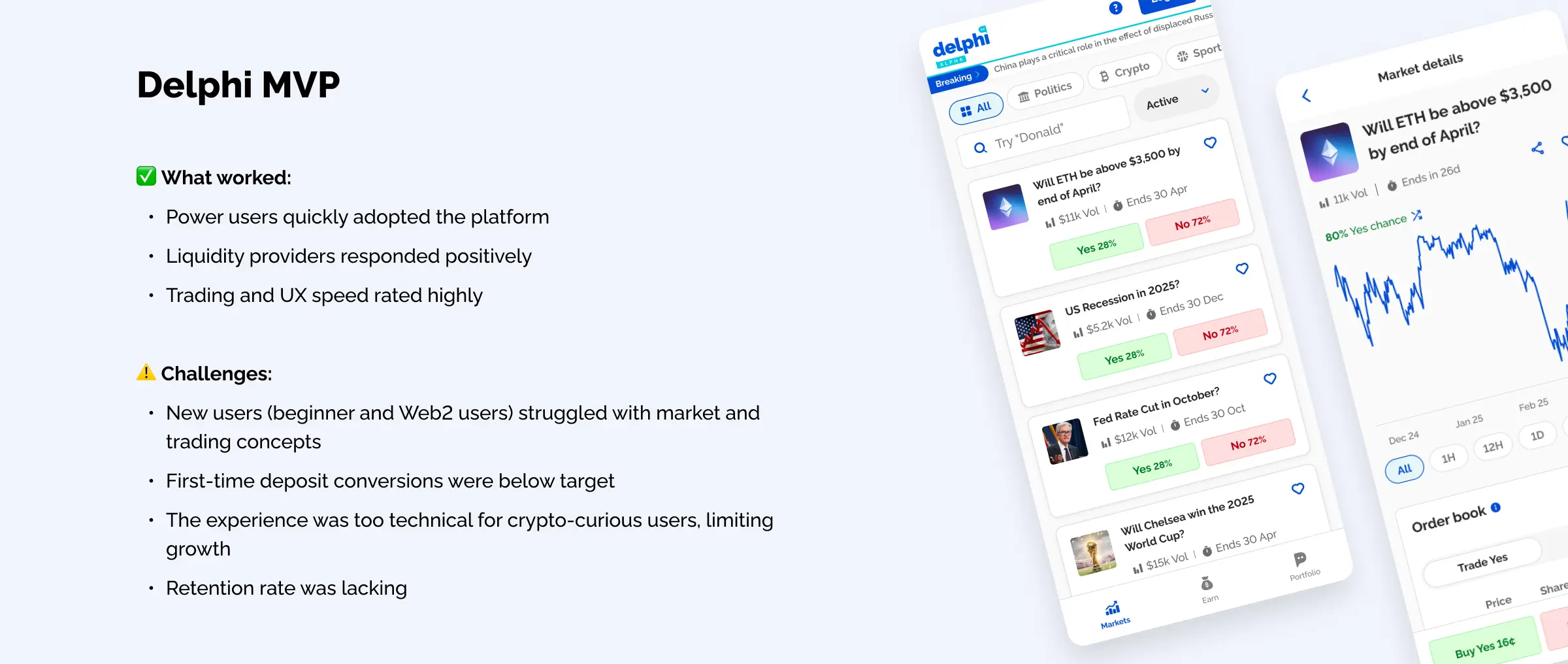

Designing and launching the MVP

After validating our prototypes, we moved into high-fidelity design, incorporating direct feedback from participants. We delivered the MVP in 6 weeks, followed by 3 weeks of post-launch iteration based on insights from users and the community.

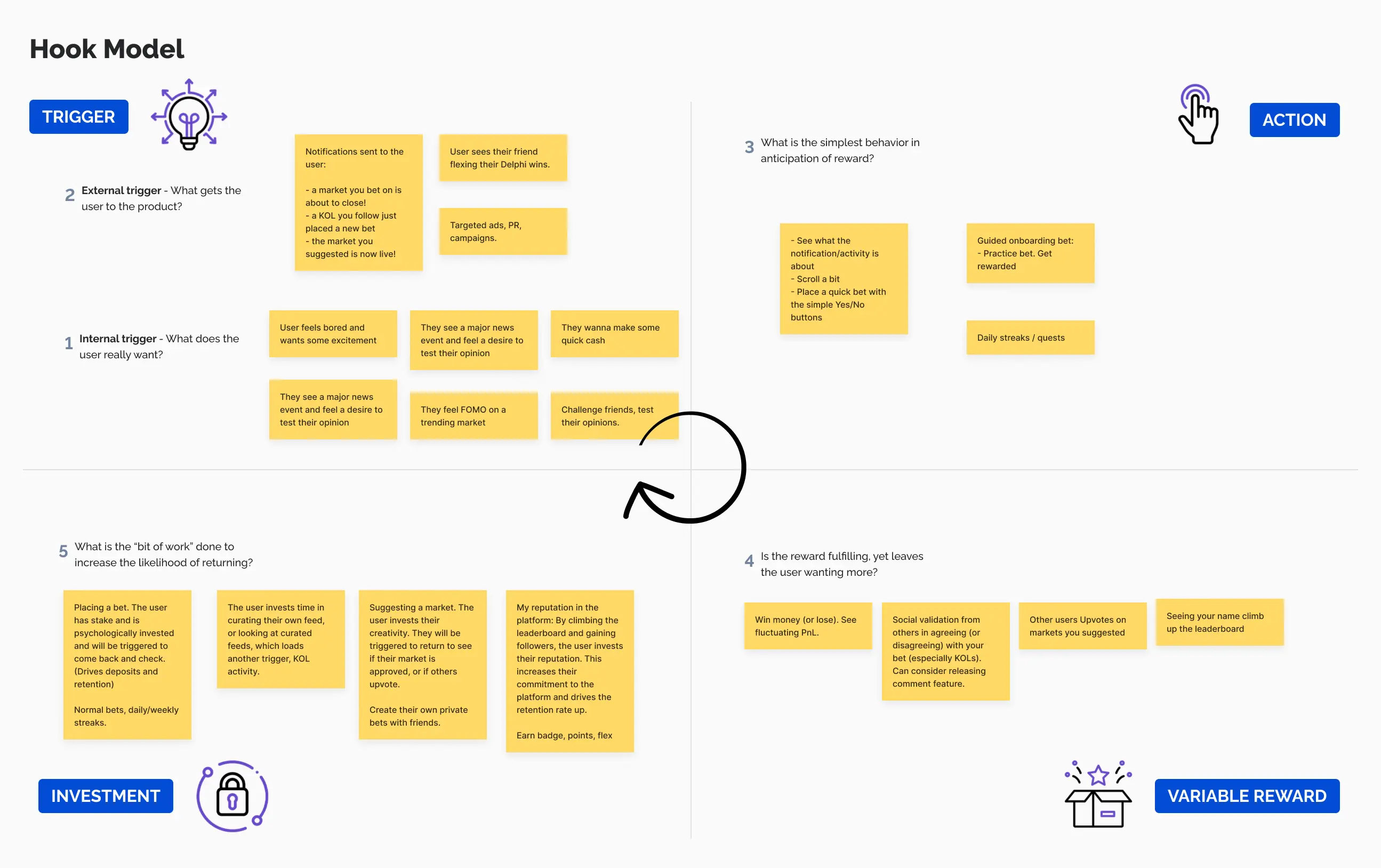

Pivoting with behavioural UX: Hook Model

To tackle retention and conversion challenges, I introduced the Hook Model into the key flows, reframing the product around a habit-forming loop with social motivators. This strategic shift became the foundation for our next iteration.

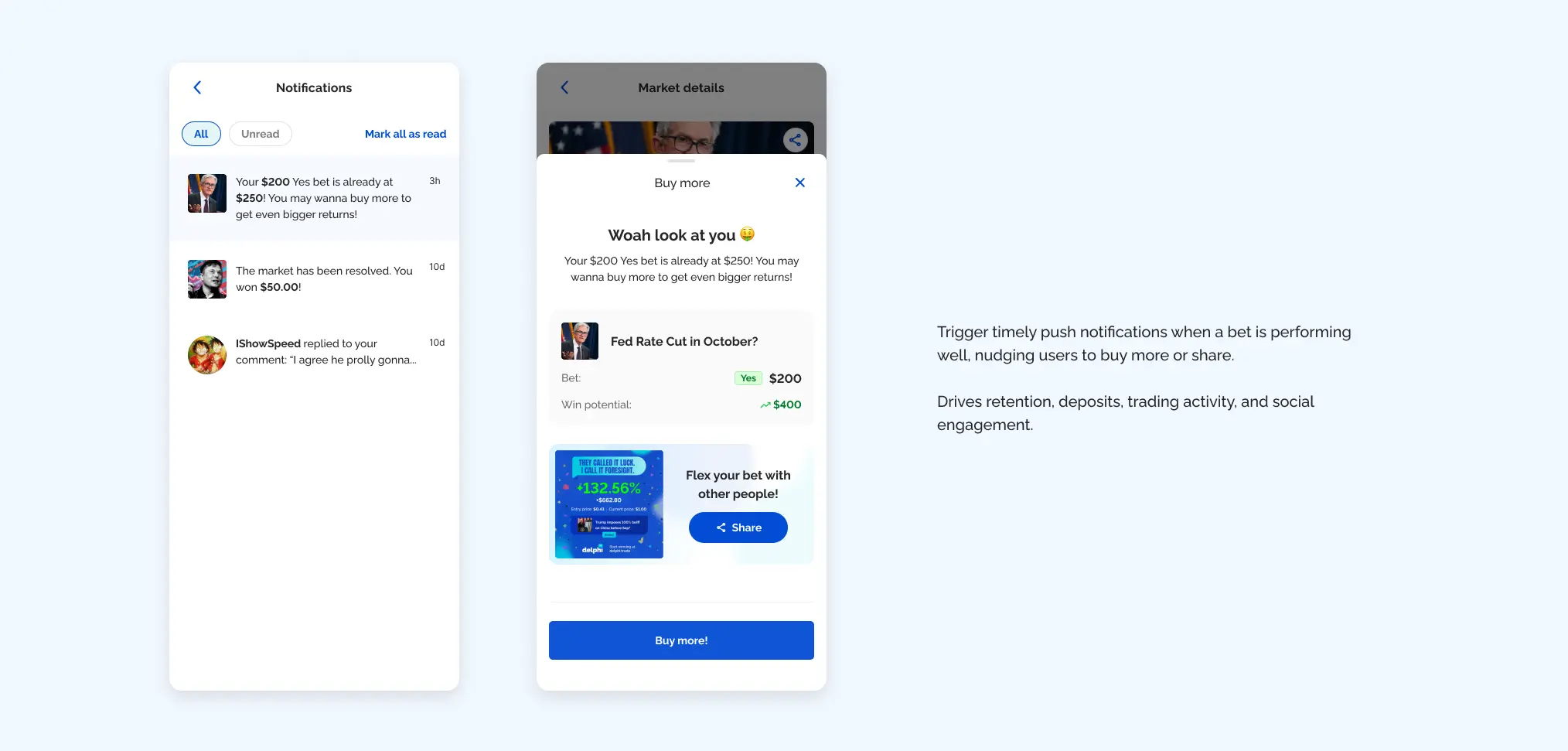

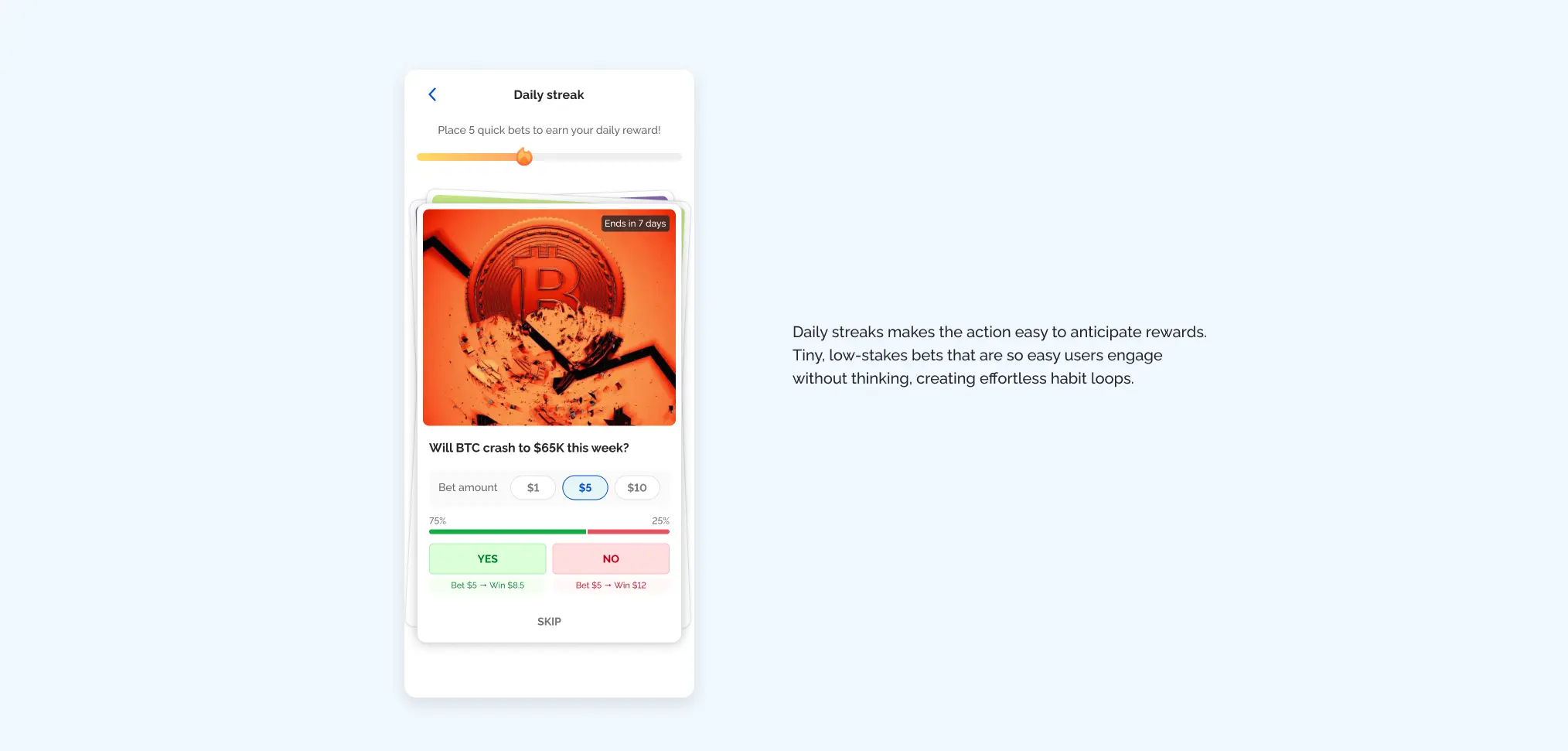

Combining internal triggers (like FOMO or curiosity) with simple actions (like placing a quick bet), variable rewards (e.g. market outcomes, social feedback), and small user investments (like tracking or creating markets). This helped drive ongoing engagement in a lightweight, intentional way.

This helped shape an experience where users not only placed bets, but returned regularly to check performance, flex wins, curate, interact, or contribute new markets.

Enhanced UX and UI

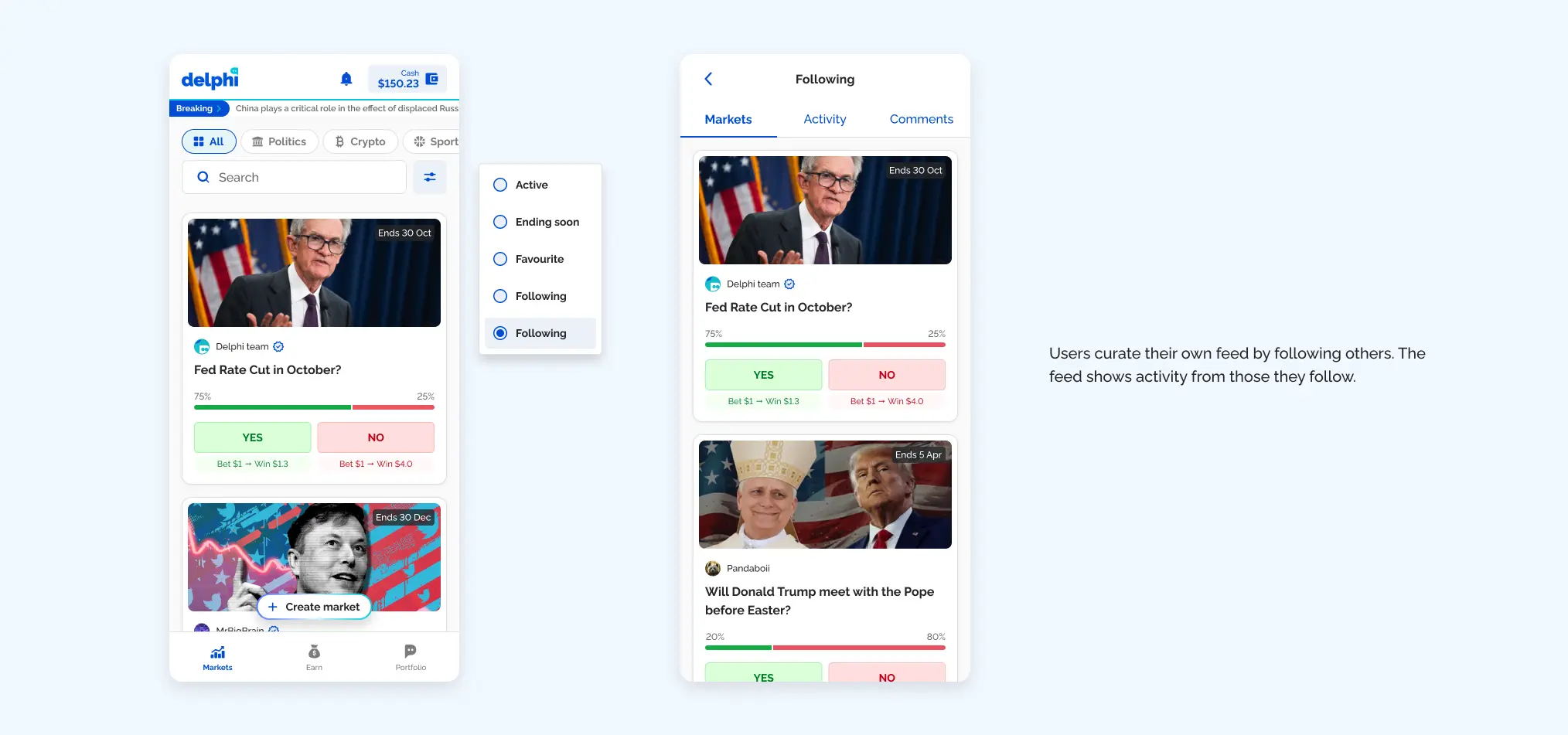

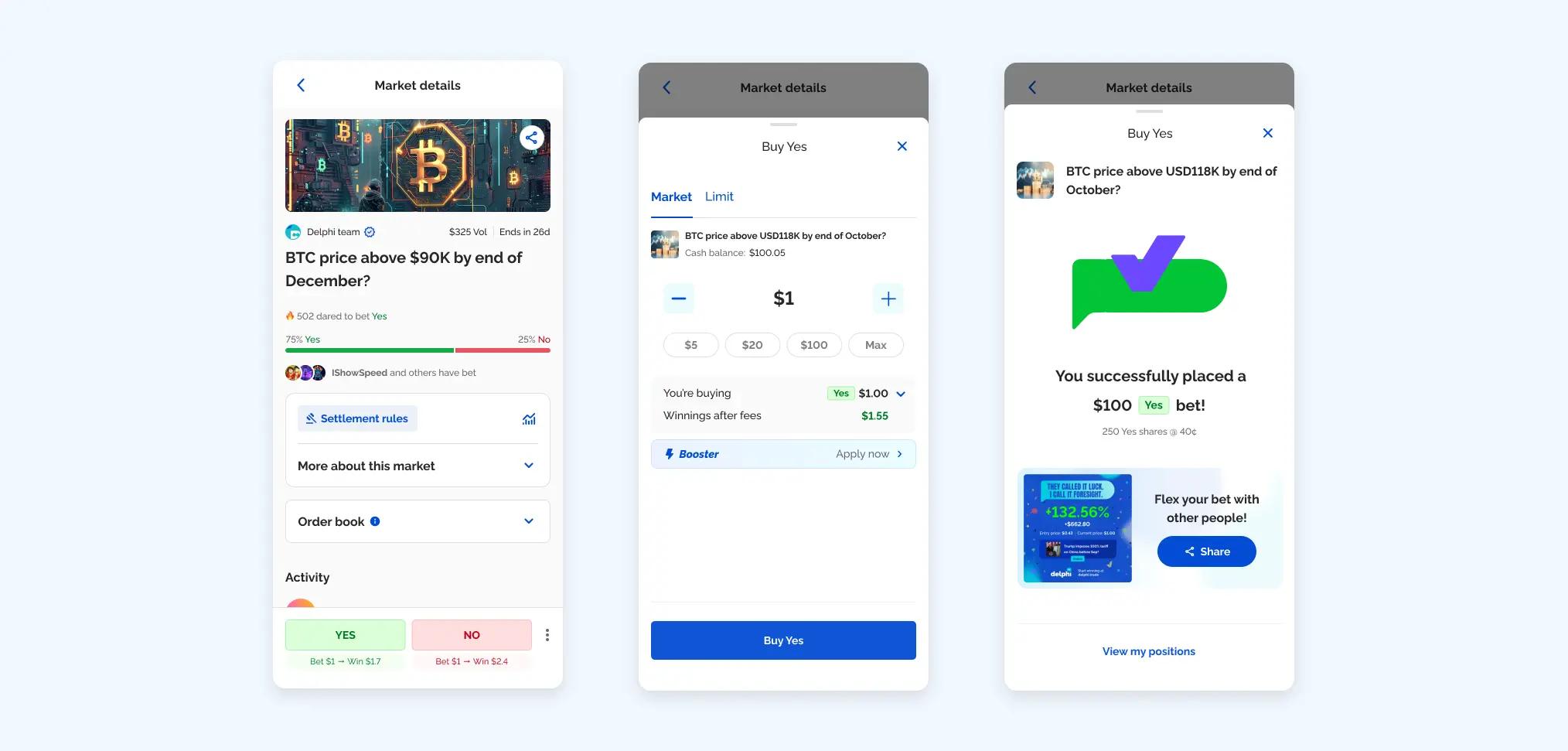

Using the Hook Model as a blueprint, we improved the UX and redesigned key flows for our next release.

💡 The key changes include:

- Redesigned a beginner-friendly UI to lower the entry barrier for first-time users, while preserving advanced features for crypto-native users

- Added visual and UX cues to guide beginners through the platform and support their path toward mastery.

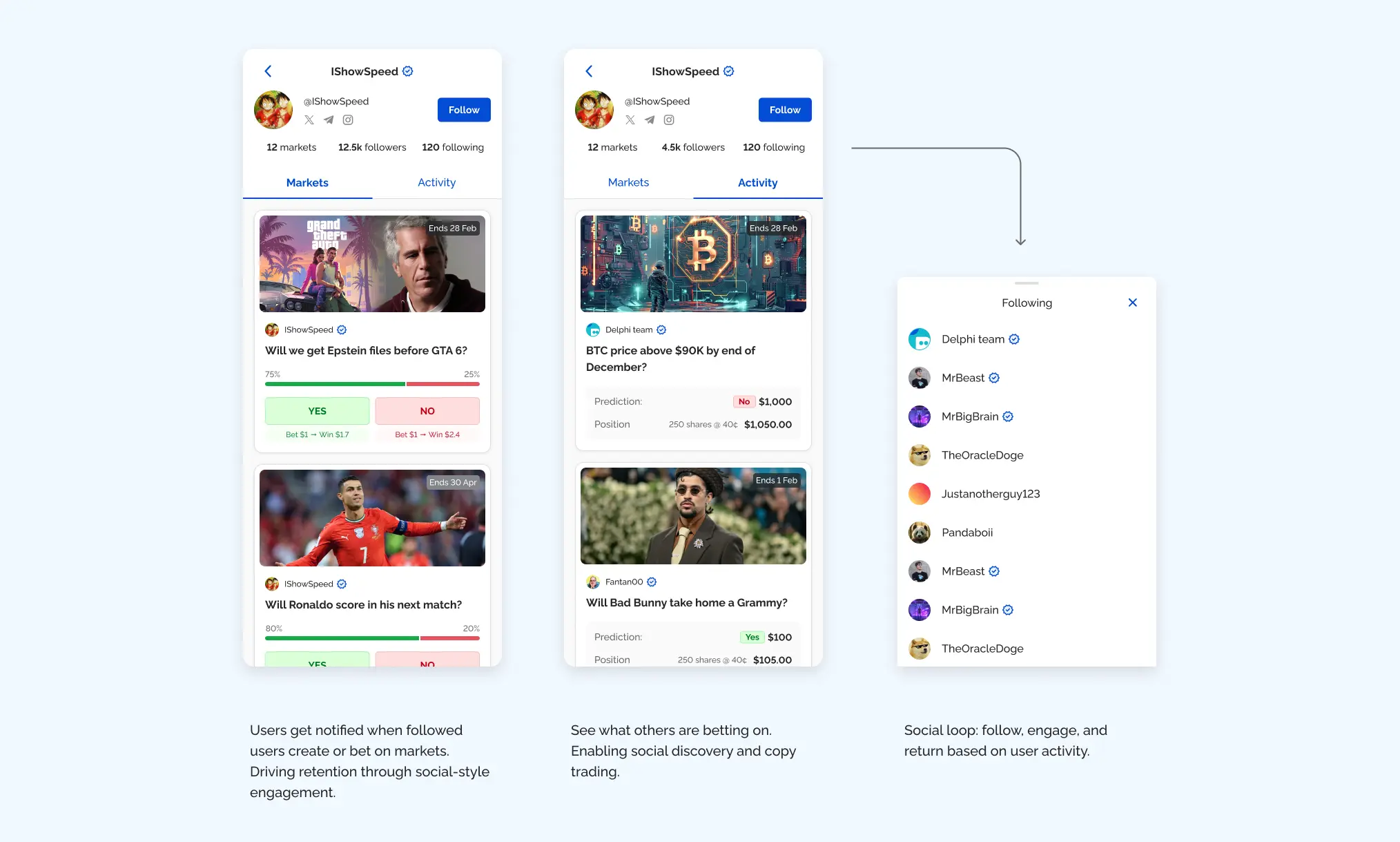

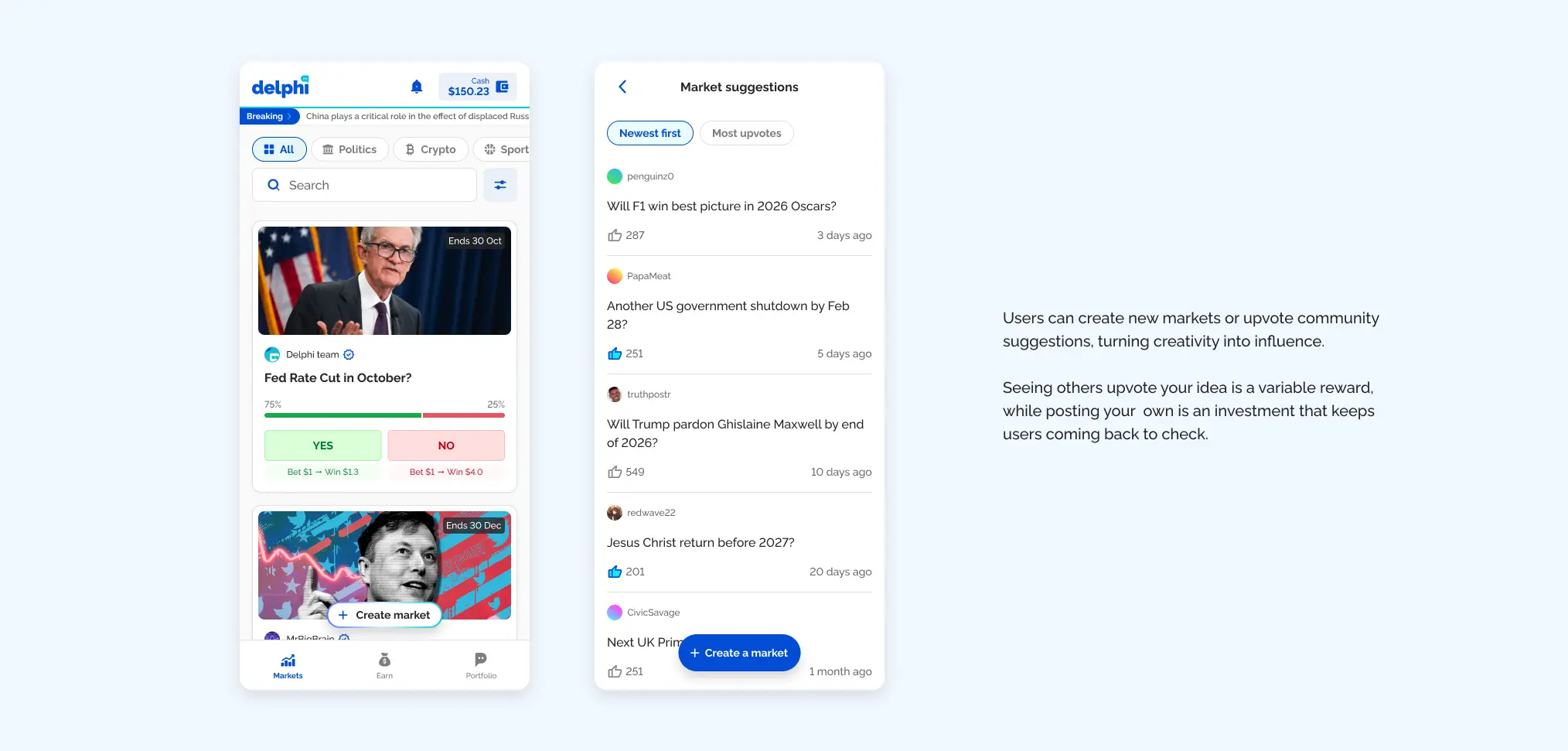

- Introduced social UX elements, such as the ability to follow users and KOLs, and view others’ trading activity, fostering engagement through visibility and community

- Stripped away the complexities of trading to create something approachable, fun, and addictive

- Gamified engagement by adding features like streaks and leaderboards to encourage daily use and return visits

- Enabled user-generated markets, allowing the community to suggest and create new prediction markets, boosting participation and platform content

Outcomes and Learnings

- By rethinking the UX through a behavioral lens, we moved the product closer to the retention, accessibility, and adoption goals

- Our focus on social, fun and intuitive design shifts helped turn initial friction into opportunity

- Habit-building and community mechanics drive long-term retention and engagement